Understanding the PPP Loan Warrant List: What You Need to Know

Introduction: What is the PPP Loan Warrant List?

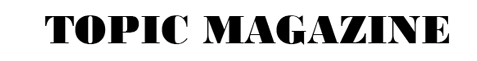

The PPP Loan Warrant List has become a hot topic for businesses, individuals, and financial experts across the United States. As part of the oversight of the Paycheck Protection Program (PPP), this list highlights businesses or individuals flagged for potential misuse or fraud related to PPP loans.

While the PPP provided much-needed relief during the COVID-19 pandemic, the program also faced challenges, including allegations of fraudulent activity. The warrant list is part of a broader initiative to ensure transparency, accountability, and trust in government-backed financial programs.

The Purpose of the PPP Loan Warrant List

1. Promoting Accountability

The PPP was designed to assist small businesses in retaining employees and staying afloat during economic uncertainty. However, with over $800 billion in loans distributed, the program faced challenges in ensuring funds were used appropriately.

The PPP Loan Warrant List identifies cases flagged for potential violations, such as:

- Submitting false information to obtain a loan.

- Using funds for unauthorized purposes.

- Inflating payroll numbers to secure higher loan amounts.

This initiative helps ensure that funds reach businesses in genuine need while discouraging misuse.

2. Preventing Fraud

Unfortunately, large-scale programs like the PPP can be vulnerable to fraud. By introducing the warrant list, the government aims to deter fraudulent behavior and pursue legal action against those who violated program rules.

The presence of a warrant list underscores the importance of adhering to loan regulations, reinforcing the program’s integrity.

How is the PPP Loan Warrant List Created?

The Small Business Administration (SBA) and other federal agencies, including the Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI), play key roles in compiling the PPP Loan Warrant List. Here’s how it works:

- Loan Data Review: The SBA reviews loan applications and forgiveness requests for discrepancies or suspicious patterns.

- Cross-Referencing Information: Authorities compare submitted loan data with other government records, such as tax filings and payroll information.

- Flagging Suspicious Activity: Loans flagged for inconsistencies are subject to further investigation, which may result in a warrant or legal action.

This multi-agency effort ensures the process is thorough, minimizing false accusations while addressing legitimate concerns.

Implications for Businesses and Individuals

The PPP Loan Warrant List has significant implications, especially for businesses flagged for investigation.

1. Legal Consequences

Being on the list doesn’t necessarily mean guilt. However, it could lead to:

- Audits by the SBA or IRS.

- Legal action if fraudulent activity is confirmed.

- Penalties, including repayment of funds, fines, or imprisonment.

2. Damage to Reputation

For businesses, appearing on the warrant list can impact their reputation. This can lead to:

- Loss of trust from customers and stakeholders.

- Difficulty securing future loans or financing.

3. Opportunity for Resolution

In some cases, businesses may end up on the list due to unintentional errors in their loan application or reporting. The SBA often provides opportunities to resolve discrepancies or disputes before escalating the issue.

How to Avoid Being on the PPP Loan Warrant List

1. Maintain Accurate Records

Always ensure your financial records are up-to-date and align with what you report in your loan application. This includes payroll information, tax filings, and expense records.

2. Use Funds Appropriately

PPP loans were intended for specific purposes, such as payroll, rent, and utilities. Avoid diverting funds for personal expenses or unauthorized business activities.

3. Seek Professional Guidance

If you’re unsure about the rules or requirements, consult with a financial expert or CPA to ensure compliance. Proper advice can save you from costly mistakes.

4. Be Transparent

Honesty is key. If you realize there’s been an error in your application or loan forgiveness request, report it proactively to the SBA.

What to Do If You’re on the PPP Loan Warrant List

1. Stay Calm and Gather Information

If your business appears on the list, start by collecting all relevant documents, including your PPP loan application, payroll records, and expense reports.

2. Seek Legal Counsel

Work with an attorney who specializes in financial regulations or fraud investigations. They can help you understand the situation and guide your response.

3. Cooperate with Authorities

Avoid ignoring communication from the SBA or other agencies. Cooperate fully to resolve the issue as quickly as possible.

Frequently Asked Questions (FAQs)

What is the PPP Loan Warrant List?

The PPP Loan Warrant List identifies businesses or individuals flagged for potential misuse of funds under the Paycheck Protection Program.

Does being on the list mean someone committed fraud?

Not necessarily. Being on the list means the loan application or usage has been flagged for further investigation.

How can I check if my business is on the PPP Loan Warrant List?

Currently, this information is not publicly available. You would typically be notified by authorities if there are concerns about your PPP loan.

Can errors in my application land me on the list?

Yes, unintentional errors such as typos, misreported figures, or incomplete information can result in your loan being flagged. It’s important to double-check all submitted documents.

The Importance of Transparency in PPP Loans

The PPP Loan Warrant List is a critical tool for maintaining the integrity of government-backed financial programs. While it has raised concerns among businesses, it ultimately serves a greater purpose: ensuring accountability and trust.

For businesses, the best approach is to stay informed, comply with loan requirements, and address any issues proactively. By prioritizing transparency and accuracy, you can safeguard your reputation and avoid unnecessary complications.

Conclusion

The PPP Loan Warrant List represents a vital step toward preventing misuse of government funds and maintaining public trust in relief programs like the Paycheck Protection Program. While being on the list can be daunting, it’s not the end of the road. With the right actions, such as seeking legal counsel, cooperating with authorities, and maintaining accurate records, businesses can resolve issues and move forward.

For business owners, this is a reminder to remain vigilant and transparent in all financial dealings. Programs like the PPP exist to support genuine needs, and by adhering to the rules, you can focus on what truly matters—building and growing your business.

By staying informed and proactive, you can protect your business and thrive in the long term.

Related Post: